For millions of Indians living and working in the UAE, sending money home isn’t just a transaction but also an act of love. It pays for a child’s education, supports aging parents, funds dreams, or simply keeps a family connected across borders.

If you regularly send money to India, you already know that timing matters. A few days, even hours, can sometimes change how many rupees your loved ones receive. So, knowing the best time to send money can make every dirham count.

Let’s break down when and how to send money from the UAE to India to get the best possible value for every dirham.

Why Timing Matters

To help you understand why timing is important, let’s take an example.

At 1 AED = 23.8 INR, 15000 AED = 357000 INR

At 1 AED = 24.02 INR, 15000 AED = 360300 INR

That’s a difference of 3300 INR just from a 0.22 change in the exchange rate. Even a small fluctuation can make a big difference, especially if you send money frequently or in large amounts.

Now you can see why timing matters. So, let’s explore when it’s the best time to send money from the UAE to India.

What Affects the AED–INR Exchange Rate

Several factors influence how the AED–INR rate moves over time. Understanding them can help you plan your transfers better.

- Oil Prices: As the UAE is a major oil exporter, strong oil prices often boost the dirham’s strength, giving you better exchange rates.

- Interest Rates & Inflation: Higher inflation or lower interest rates in India can weaken the rupee, thus increasing the conversion value.

- Trade Balance & Imports: India’s reliance on imports can put pressure on the rupee, especially when global prices rise. This can be advantageous when you send money to India.

- Global Market Changes: Political changes, U.S. dollar trends, or economic data from major economies all affect how the rupee performs.

Regularly keep an eye on these trends so that you can anticipate when your dirham will go further in India.

Want to know in detail why exchange rates keep changing? Read our article on exchange rates.

Best Time to Send Money From UAE to India

To send money at the best rates, it’s important to know when to send your money.. Based on market trends and expert insights, we have sorted for you most favorable times to transfer money from the UAE to India:

(i) Before Major Festive Seasons: During festival seasons, remittance volumes will be high, and exchange houses may raise transfer fees. For better rates, send money a week or two before festive demand peaks.

(ii) During Economic Calm: Stable oil prices, low inflation, and steady interest rates in both countries usually results in more consistent currency movement. Hence, you can confidently send money without fear of sudden rate drops.

(iii) In the Middle of the Month: Avoid sending money right after payday or at the end of the month when remittance activity peaks. Mid-month transfers typically offer more favorable rates and lower fees.

(iv) When Transfer Fees Are Low: Compare the transfer fees across different money transfer services and choose the one that offers the lowest fee hence increasing overall value.

(v) When INR Weakens: A weaker INR means you get more value per dirham. When the INR weakens due to global or domestic factors, UAE senders get more rupees per dirham, making it an ideal time to send.

Read and find out how AI Will Impact Money Transfer in the Future!

Historical AED–INR Exchange Rate Trends

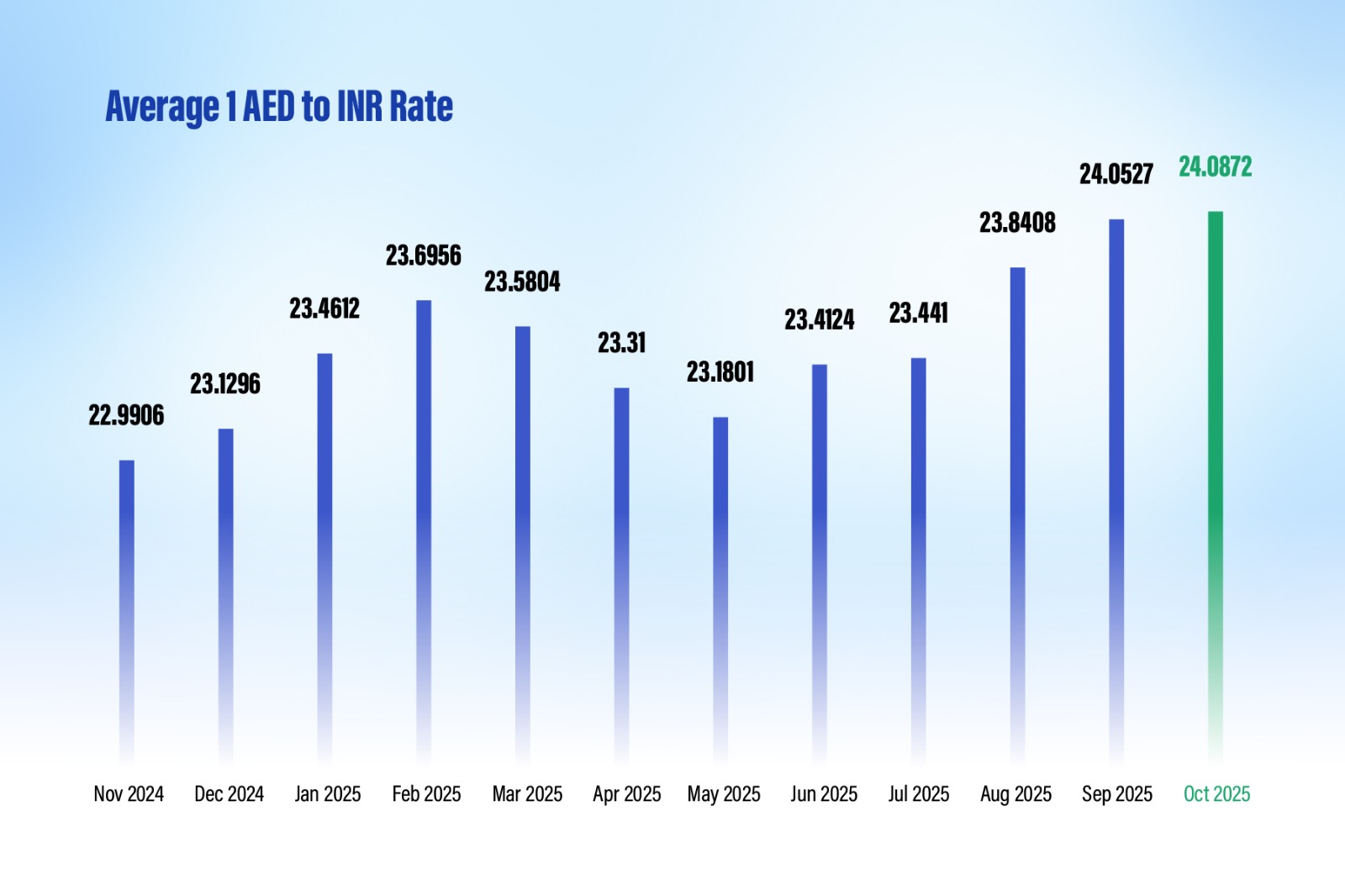

The chart shows almost a steady rise in the AED to INR rate which is around INR 22.99 in November 2024 to INR 24.08 in October 2025. This indicates that the Indian rupee gradually weakened against the dirham, giving UAE senders more value per transfer over time.

Rates surged between December and February, dipped slightly around April–May, and peaked again from August to October, making these the best months to send money from the UAE to India.

However, these fluctuations vary each year, so it’s always wise to keep an eye on live exchange rates before making a transfer.

Send Money to India Now Using LuLu Money App!

Tips to Send Money at the Best Exchange Rates

If you follow a few simple habits, you can increase your chances of sending money at the best AED to INR rates. Here’s how:

Use Rate Alerts

Apps like LuLu Money offer rate alert features that notify you when the AED to INR exchange rate reaches your preferred value. This helps you time your transfer and lock in the best rates.

Plan Regular Transfers

Instead of sending a large amount in a single transfer, split it into smaller ones. Try sending one part early and the other mid-month. It helps average out any rate fluctuations.

Compare Before Sending

Always compare the live rates, service fees, and processing times across different platforms. Apps and exchange houses often offer better rates than traditional banks.

Choose a Reliable Channel

Always use licensed and secure remittance providers. With LuLu Money, you can send directly to any Indian bank account with live rates, quick processing, and peace of mind.

Here are the reasons as to why AED is pegged to USD!

Frequently Asked Questions

Is it cheaper to send money during weekdays or weekends?

Weekdays usually offer slightly better rates since global forex markets are open. Weekends may reflect Friday’s closing rates. For the best rates, check just before market closure (especially on Thursday evening UAE time).

How do global oil prices affect AED to INR exchange rates?

When oil prices are strong, the UAE’s currency remains stable or slightly stronger thus giving senders more value per dirham during transfers to India.

Can minor changes in exchange rates really make a difference?

Absolutely. Even a 0.20 change in the AED to INR rate can mean hundreds or thousands of extra rupees on larger transfers. Always check the latest rate before sending money.

Is it better to transfer money in one go or in smaller amounts?

If rates are favourable, send in one go for a better value. When rates are uncertain, splitting transfers can help you average out the rate.

What should I do if the exchange rate is low but I need to send money urgently?

In such cases, focus on reliability over rate. Using trusted platforms like LuLu Money ensures your funds reach safely and quickly, while frequent users can enjoy loyalty rewards and future high-rate windows.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025