Imagine picking up your phone to send money from the UAE to your family in India — only to see that the INR amount showing today is less than what you saw yesterday. How did this happen? Why did the rate change? The reason? Exchange rate fluctuations.

So, what exactly is the exchange rate? And why does it change every time?

Let’s learn the reasons behind this and find out why your family receives more or fewer rupees for the same AED.

What Are Exchange Rates?

Exchange rates, also known as foreign exchange rates or forex, refer to one country’s currency value when compared to another country’s currency. If you are planning to send money from UAE to USA, the 1 AED you send is equivalent to 0.27 USD but this value is not constant). This is what we call the exchange rate.

Exchange rates can be floating or fixed. Here’s the difference:

- Floating exchange rate – Exchange rate where the currency’s value varies with events in the foreign exchange market.

- Fixed exchange rate – Exchange rate where the currency’s value is fixed or pegged to another currency, material goods, a set of currencies, or a measure of value such as gold or silver.

And these rates keep on changing based on several factors. Let’s see what those factors are.

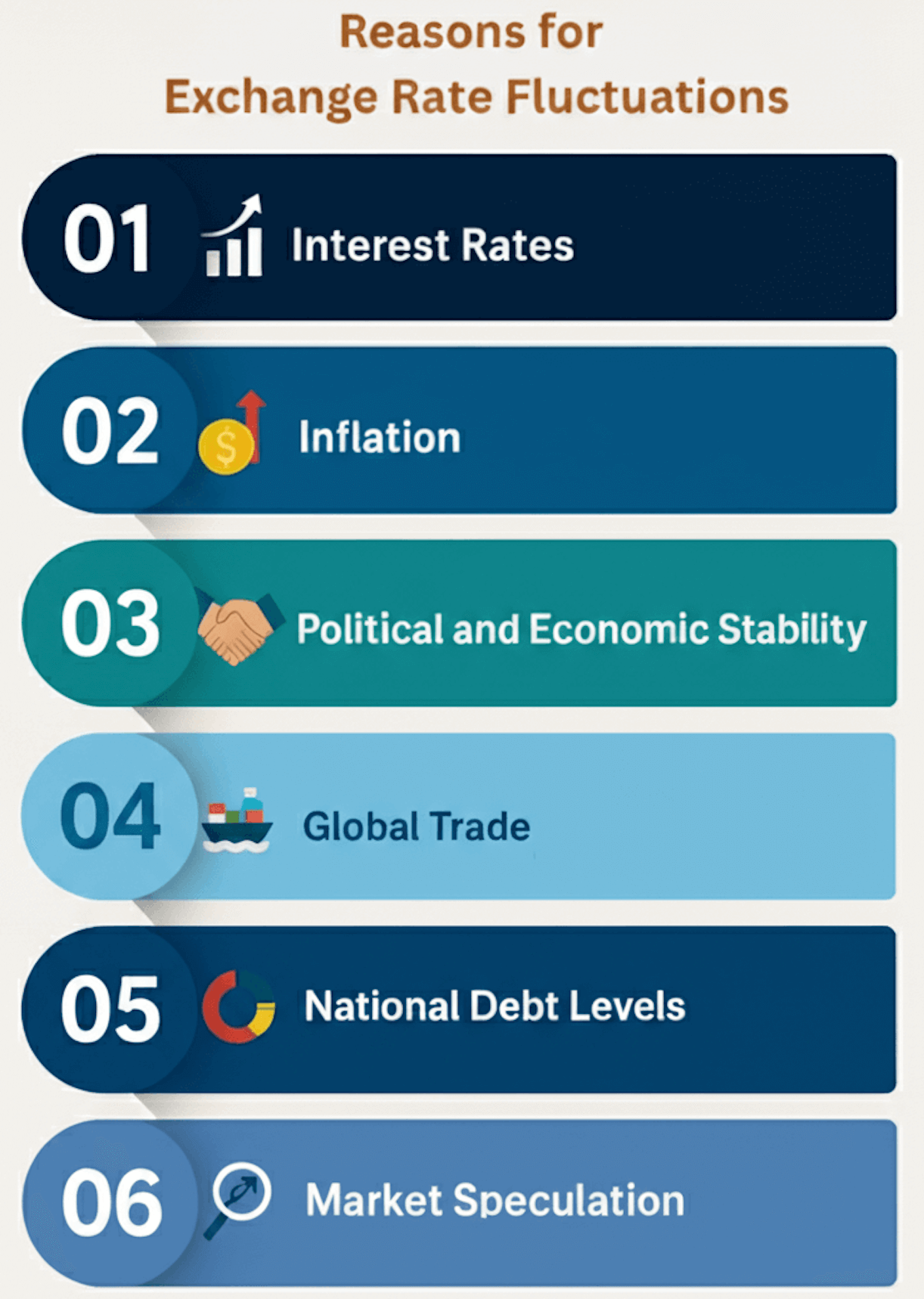

Here’s Why Exchange Rates Fluctuate

If you’re someone who sends money abroad, travels internationally, invests overseas, or runs a global business, it’s important to know the live currency exchange rates and why they vary.

Now let’s have a look at the reasons as to why exchange rates fluctuate.

Interest Rates and Inflation

Both interest rates and inflation are interrelated. If a country faces high inflation, its currency’s value weakens over time. Hence, to improve the currency strength and thereby the purchasing power, the central bank of the country will raise interest rates.

Higher interest rates attract foreign investors who look for better returns, which in turn boosts demand and strengthens the currency’s value.

For example, if the UAE raises its interest rates while the USA keeps theirs steady, the dirhams become more attractive and the dollar weakens in comparison. That would directly affect the AED/USD exchange rate.

Political and Economic Stability

Investors prefer to put their money in countries that have strong governance, stable politics, and healthy economic growth. Those countries are expected to have stronger currencies.

Any uncertainties such as elections, conflicts, or economic slowdowns can pull back investors which can weaken the currency value.

Global Trade

If a country’s export prices rise faster than their import prices, it shows how stable the country’s economic situation is. This drives their currency demand leading to higher revenue and thereby strengthening the currency value.

National Debt Levels

A country that has high debt levels may need to borrow or print more currency which in turn leads to inflation and reduced investor confidence. This can weaken the currency value, so you will need more of that currency to buy a stronger currency. Conversely, low debt levels can strengthen the currency.

Have a look at the world currency symbols!

Market Speculation

When traders or investors feel that a currency will strengthen in the future, they buy large amounts of it, increasing demand and boosting its value. But fears of bad news or instability lead them to sell, weakening the currency. These speculative moves can cause sudden spikes or drops even before real economic changes occur.

For example, if the traders believe that the U.S. will raise the interest rates, they will buy more USD in advance expecting the currency value to strengthen soon. Conversely, if traders hear a rumor about an economic crisis, they might panic and sell USD, thus causing its exchange rate to drop instantly.

FAQs

How are currency exchange rates determined?

Currency exchange rates are determined by the supply and demand for different currencies in the global forex market. Factors like interest rates, inflation, political & economic stability, global trade, national debt levels, and market speculation influence this demand. In certain cases, central banks intervene to adjust or stabilize the rates.

How do forex rates affect businesses?

They affect businesses by bringing fluctuations in the cost of imports and the revenue from exports. With a weaker local currency, imports are more expensive but it can increase export earnings, while a stronger currency does the opposite. These variations can directly impact profits, pricing, and competitiveness in global markets.

How do forex rates affect an economy?

Forex rates can affect an economy by shaping the cost of imports & exports, which can thereby influence the trade balance and economic growth. Currency value fluctuations can influence inflation.

What does increased exchange rates mean?

Increased exchange rates mean the base currency is strong and can buy more of the other currency. For example, if the USD/INR rate rises from 84 to 85, one US dollar can now buy more Indian rupees, showing a stronger dollar relative to the rupee.

When is the best time to send money to get a better exchange rate?

There’s no fixed “best” time, as rates fluctuate daily based on global events. Monitoring trends or using rate alerts from transfer apps can help you send when the rate is favorable.

Can I lock an exchange rate before transferring money?

Some transfer services allow you to lock a rate for a short period, but not all providers offer this feature. In the LuLu Money App’s rate alert settings, you can set your desired rate alert and get notified at the right time.

Do money transfer apps show real-time exchange rates?

Yes, LuLu Money app shows real-time exchange rates which get updated frequently.

How fast are transfers processed through money transfer apps?

Transfers made through LuLu Money App get delivered within seconds.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025