In a world of constant global money flows, one currency stands out from the others, the United States Dollar. Be it a money transfer from UAE to Kuwait, OMR to GBP currency exchange, or daily forex rate analysis, the dollar influences it all.

Movements in dollar values ripple through every transaction. So the question is, why does the USD hold such power? Why does a shift in the American economy affect the world’s exchange rates? It’s time to find out.

Dollar – The World’s Financial Anchor

The US dollar is not just America’s currency, it’s the centre of the global financial system. After World War II, based on the Bretton Woods Agreement, most world currencies were pegged to the USD, while the dollar itself was backed by gold.

Even after the system ended in the 1970s, the dollar continued to maintain its dominance. Over 80% of global trade and 60% of central bank reserves are held in USD.

In short, when the dollar moves, the currency rates move.

Check the AED to USD rates!

How the USD Shapes Other Currency Rates

Movements in dollar value create a ripple effect across most major currency values. Want to know why? Here are the reasons:

The Dollar Is the World’s Default Trade Currency

Oil, gold, and gas which are major global commodities, are priced in USD. Changes in the dollar value causes changes in the price of these commodities thereby causing fluctuations in the currency values of the countries purchasing these commodities.

Global Investors Treat the USD as a Safe Haven

During uncertain times, global investors rely on the US dollar. This increased demand for USD weakens other currencies.

US Interest Rates Influence Global Money Flows

As the US Federal Reserve raises interest rates, investors are more likely to move funds to the US for better returns. This increases demand for USD which in turn puts pressure on other currencies.

Many Countries Borrow in USD

Most developing countries take loans in dollars. When the dollar strengthens, repaying debt adds stress to their financial systems, often leading to weaker local currencies.

Central Banks Hold USD as a Primary Reserve

Most central banks hold large reserves in US dollars. Any change in these holdings, or in confidence toward the US economy, shifts global demand for the dollar, influencing the value of other major currencies.

What Gives the US Dollar Its Global Strength

The US dollar has great control over the exchange rates of other currencies. Why is that so? Here are the key reasons behind its global strength.

Large and Stable US Economy

The US economy is one of the world’s strongest, most transparent, and most resilient economies. As a result, global governments, banks, and investors consider USD as a trustworthy store of value.

Deep, Liquid Financial Markets

The US has the biggest and most accessible financial markets. Anyone can buy or sell USD assets easily, in huge volumes, without affecting prices too much. No other currency offers this level of liquidity.

The USD’s Dominance in Global Trade

To buy commodities such as oil, gold, natural gas, machinery, and electronics, which are priced in USD, countries need dollars. This forces other countries to hold and use more USD, strengthening its dominance.

Network Effect: Everyone Uses It Because… Everyone Uses It

Similar to platforms like Google, once the world adopts a system widely, it becomes very hard to replace. USD is deeply embedded in international trade, cross-border payments, forex markets, global debt, and remittances.

All the above mentioned factors keep the USD powerful.

Why This Matters for Your Money Transfers

Changes in USD values result in variations in the global currency values. Understanding the dollar’s behaviour helps you in the following ways:

- Send money when you get better value

- Read market trends more confidently

- Understand why rates change day to day

This is especially useful for expats in the GCC and other countries who send money regularly.

Download the LuLu Money App and send money at the best rates!

How Will Dollar Value Fluctuations be Useful for Expats?

For millions of expats living in the UAE, Saudi Arabia, Kuwait, Oman, Bahrain, and Qatar, it is important to understand how changes in the US dollar values affects how much their families receive back home.

Consider that you’re an expat in the UAE sending AED to INR. When USD strengthens in the global market, INR weakens as it is sensitive to USD movements.

Let’s understand this with an example.

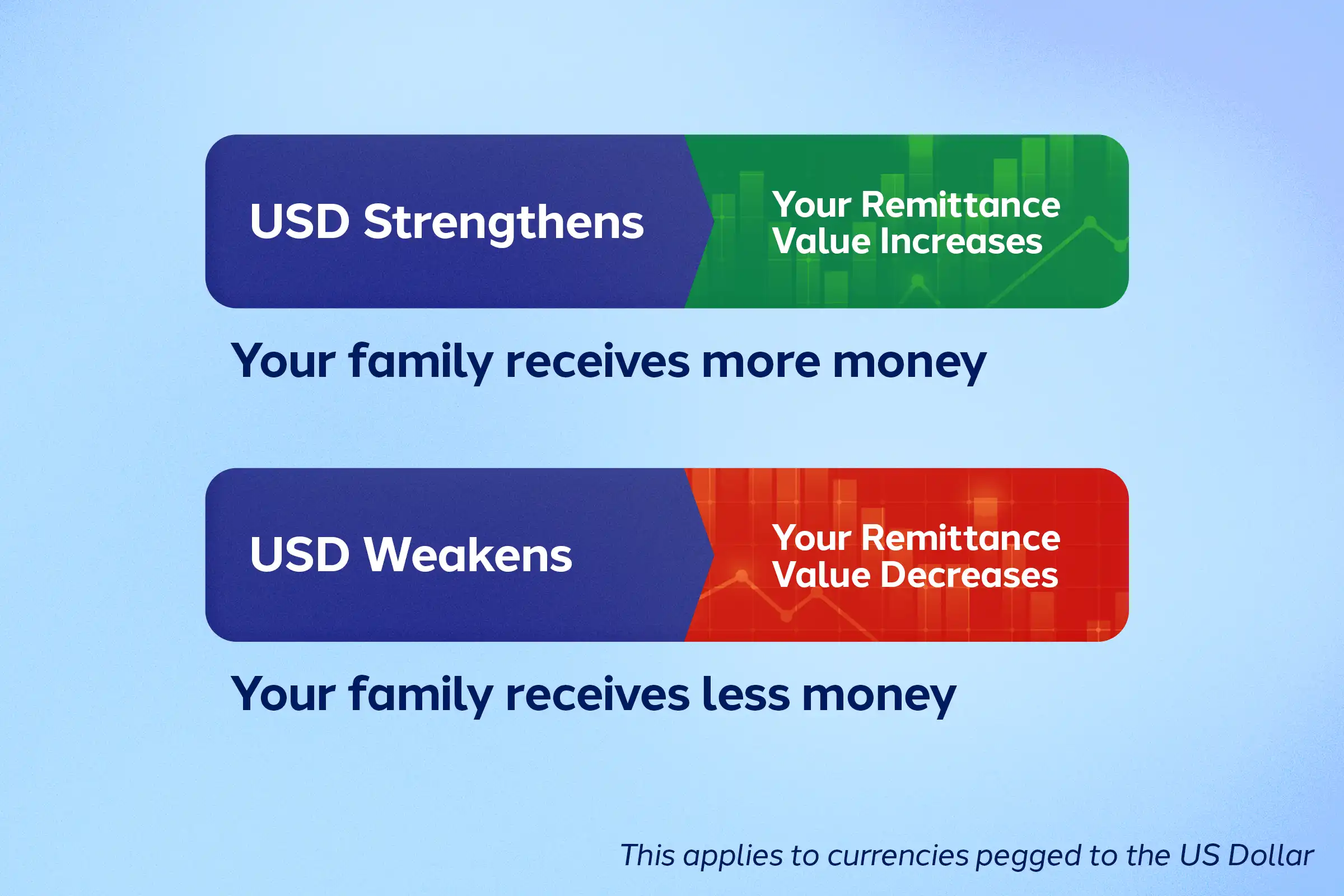

So, here’s how remittance value get affected as USD strengthens or weakens:

A stronger USD means expats can send more money home without spending extra.

Find out the best time to send money from the UAE to India!

Can BRICS Reduce the World’s Dependence on the US Dollar?

To reduce the dependence on the US dollar, especially in energy and commodity trade, BRICS (Brazil, Russia, India, China and South Africa) started to actively explore alternatives to the US Dollar. This includes settling trade in local currencies and also introducing BRICS currency.

However, experts note that the US dollar continues to dominate due to its deep liquidity, established financial infrastructure and widespread global usage. From central bank reserves to international payments and commodity pricing, the USD still anchors the global financial system.

In short: BRICS may gradually reduce reliance on the dollar, but the USD’s dominance remains secure for the foreseeable future.

Frequently Asked Questions

Will USD affect the remittance value?

Yes. When USD strengthens, it weakens most emerging market currencies often resulting in better conversion rates. This will be useful when sending AED, SAR, OMR, or KWD to countries like India, Pakistan, Sri Lanka, or the Philippines.

Why are global commodities priced in USD?

Because the USD offers stability, liquidity, and global trust. It is the easiest currency to use for standardising prices across countries.

What happens to exchange rates when the US raises interest rates?

With higher interest rates, there will be higher foreign investment into US markets. This strengthens USD and weakens other currencies improving the exchange rates for remitters.

What changes happen to other currencies with changes in US inflation?

High inflation in the US weakens the USD, while controlled inflation strengthens it and global currencies tend to react accordingly.

Are there any chances that the US dollar will lose its global dominance in the future?

While other currencies are rising in importance, no currency currently matches the USD in trust, liquidity, and global usage.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025