On a global scale, businesses rely on multiple currencies for both trade and transactions. Currency strength can influence everything from import and export prices to interest rates, inflation, and foreign investment ultimately shaping a country’s economy. Hence having knowledge about the world’s strongest currencies is important, especially when dealing with international trade, investment, or travel.

A strong currency improves purchasing power and reduces import costs, while a weaker one makes exports more competitive on the global stage. Let’s take a closer look at the world’s 10 strongest currencies.

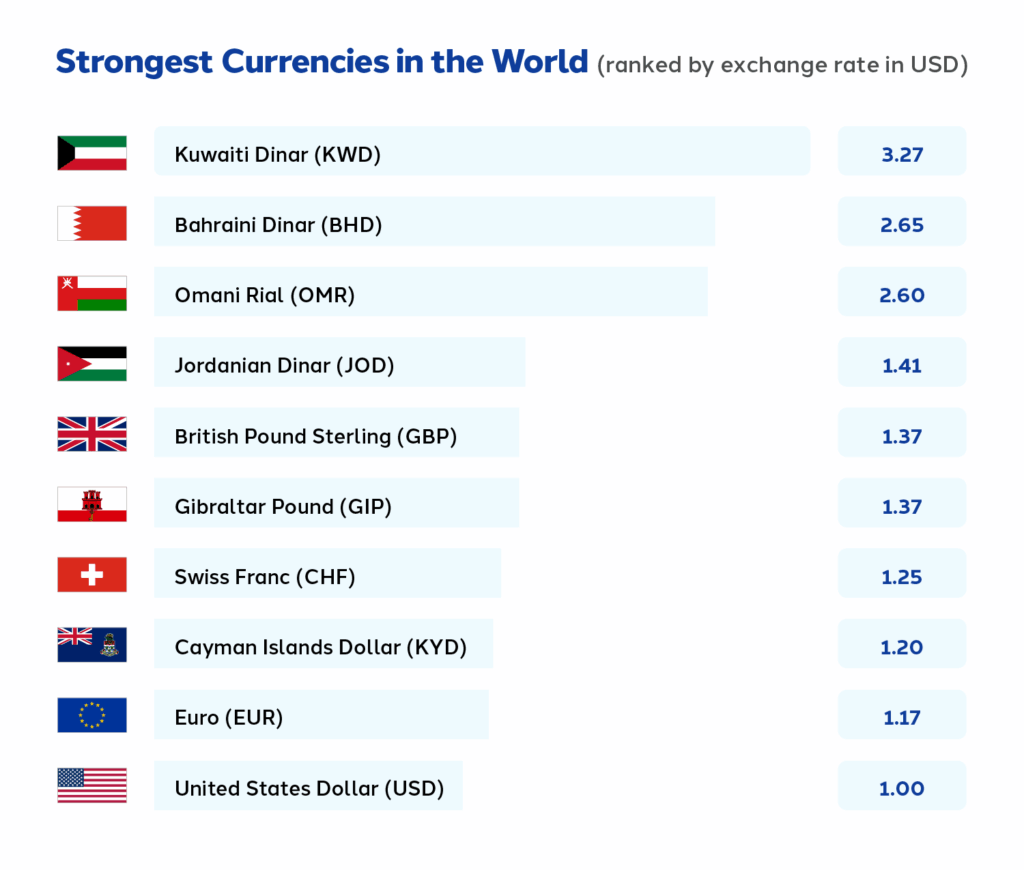

To make comparison easier, we’ve listed the exchange rate of each currency against the US Dollar. You can also check live exchange rates to stay updated before making any conversions or money transfers.

So which are the top 10 strongest currencies in the world? Let’s have a look.

Kuwaiti Dinar (KWD)

Exchange Rate: 1 KWD = 3.27 USD

Kuwaiti Dinar (KWD), the official currency of Kuwait is recognised as the world’s most powerful currency. KWD which was introduced in 1961 replacing the Gulf Rupee is a symbol of Kuwait’s economic strength and financial stability. The country’s vast oil reserves, the high demand for oil, extensive transactions in KWD, and stable monetary policies make it the most expensive currency in the world.

Bahraini Dinar (BHD)

Exchange Rate: 1 BHD = 2.65 USD

Bahraini Dinar (BHD), which replaced the Gulf Rupee in 1965 is known to be the next strongest currency in the world. It’s the country’s oil wealth and strong financial sector that contributes to their economic strength. BHD’s exchange rate has remained unchanged for years, reflecting Bahrain’s financial resilience.

Here are the weakest currencies in the world!

Omani Rial (OMR)

Exchange Rate: 1 OMR = 2.60 USD

Next comes the Omani Rial (OMR), the official currency of Oman. It was introduced on 11 November 1972 after replacing the Indian Rupee, the Maria Theresa Thaler, the Gulf Rupee, and the Saudi Rial. Its strength comes from excellent monetary policies, extensive oil production & export, and political stability thus adding value to the currency on a global scale.

Jordanian Dinar (JOD)

Exchange Rate: 1 JOD = 1.41 USD

Jordanian Dinar (JOD), known to be the fourth strongest currency in the world became the country’s official currency and legal tender on 1 July 1950. Although Jordan is not known to have major oil reserves, Jordanian Dinar has a stable currency value due to the country’s strong financial operations and steady flow of international support. It’s due to the currency’s stable value that it is known to be one of the most dependable currencies.

British Pound Sterling (GBP)

Exchange Rate: 1 GBP = 1.37 USD

Sterling also known as the British pound or the pound sterling (GBP) is the world’s oldest & fourth-most-traded currency and fourth most-held reserve currency in global reserves. GBP is the official currency of not just Britain but also its nine associated territories. The global demand, strong economy, Bank of England being the central bank, stable economic policies, and its recognition as a reliable asset makes it one of the strongest currencies in the world.

Also Read: What Is a SWIFT Code and Why Do You Need It?

Gibraltar Pound (GIP)

Exchange Rate: 1 GIP = 1.37 USD

The next in the list is the Gibraltar Pound (GIP) which is the official currency of the British Overseas Territory – Gibraltar. The Government of Gibraltar issues its own banknotes and coins. Its strength comes from the stable banking sector, reliable economic policies, and its strong bond with the British Pound Sterling (GBP).

Swiss Franc (CHF)

Exchange Rate: 1 CHF = 1.25 USD

The Swiss Franc (CHF), the currency of both Switzerland and Liechtenstein, is considered one of the world’s strongest currencies due to the country’s economic stability, strict financial policies, and global reputation as a safe haven. CHF was recognized as Switzerland’s currency in May 1850. Its strength is further supported by investor trust during global downturns, a strong banking sector, and the country’s focus on high-value exports and innovation.

Cayman Islands Dollar (KYD)

Exchange Rate: 1 KYD = 1.20 USD

Next comes the Cayman Islands Dollar (KYD), the currency of the Cayman Islands which was introduced in 1972 after replacing the Jamaican dollar. The exchange rate of the Cayman Islands Dollar (KYD) has remained fixed at 1 KYD = 1.20 USD since 1974. Strong banking and investment sector, continuous international funding, and the absence of direct taxation that attracts financial industries worldwide makes KYD one of the strongest currencies in the world.

Euro (EUR)

Exchange Rate: 1 EUR = 1.17 USD

Euro (EUR) is the world’s second-most traded and second-largest reserve currency after the US Dollar. Out of 27, 20 of the European Union’s member states have Euro as their official currency and it was introduced on 1st January 1999. Each Euro is divided into 100 smaller units called euro cents. Euro has a global reach; It is not only used by hundreds of millions in Europe but also millions worldwide through its pegged counterparts.

The Euro remains strong due to the economic power of key Eurozone nations and its vital role in global trade and financial markets. It also reduces the risk for member countries, thereby boosting stability and trust.

United States Dollar (USD)

The United States Dollar (USD) is the international reserve currency, the most widely used currency in international transactions, and a free-floating currency. USD, the official currency of the United States and several other countries, was introduced on April 2, 1792.

So why is the United States Dollar so strong? It can be attributed to the United States — the world’s biggest global economy which is trusted for its high stability and liquidity, and supported by firm Federal Reserve policies and global demand.

Disclaimer: All exchange rates are subject to change at any time based on market conditions.

Bottom Line

Before starting a business, investing abroad, trading internationally, or planning a trip overseas, it’s important to understand the strength of global currencies and the economic power behind them. As you’ve seen in this article, a currency’s strength isn’t just about how widely it’s used — it depends on factors like economic stability, government policy, market trust, and global demand. In short, understanding what makes a currency strong puts you one step ahead in a global economy.

So, if you are planning to send money securely across the borders, download the LuLu Money App.

FAQs

Which is the strongest currency in the world?

The Kuwaiti Dinar (KWD) is the strongest currency in the world.

Why is the Kuwaiti Dinar so strong?

The Kuwaiti Dinar (KWD) is strong due to high oil demand, extensive transactions in KWD, and stable monetary policies that boost the currency’s value.

What determines the strength of a currency?

Various factors that determine the strength of a currency are a country’s economic & political stability, inflation & interest rates, trade balance, government debt, and currency’s global demand.

Is the most used currency always the strongest?

Not necessarily. Although the US Dollar is the most widely used and traded currency globally, it is not the strongest. Currency strength is determined by various other factors including its usage.

What are the advantages of using a strong currency?

It increases purchasing power, helps control inflation, lowers import costs, and boosts investor confidence.

How does having a fixed exchange rate help in maintaining the currency strength?

A fixed exchange rate provides stability and predictability, especially with the assistance of a strong financial sector and consistent foreign capital inflow.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025