Imagine you’re in the UAE, ready to send money to your family in Europe. Just when you think you’re done filling in all the details, you’re asked for something called a SWIFT code. If you’re hearing about it for the first time, questions start popping up: What is a SWIFT code? Where do I find it?

To answer this, we’ve broken down for you what a SWIFT code is, why it’s important, and how it makes your international transfers smooth and secure.

What Is a SWIFT Code?

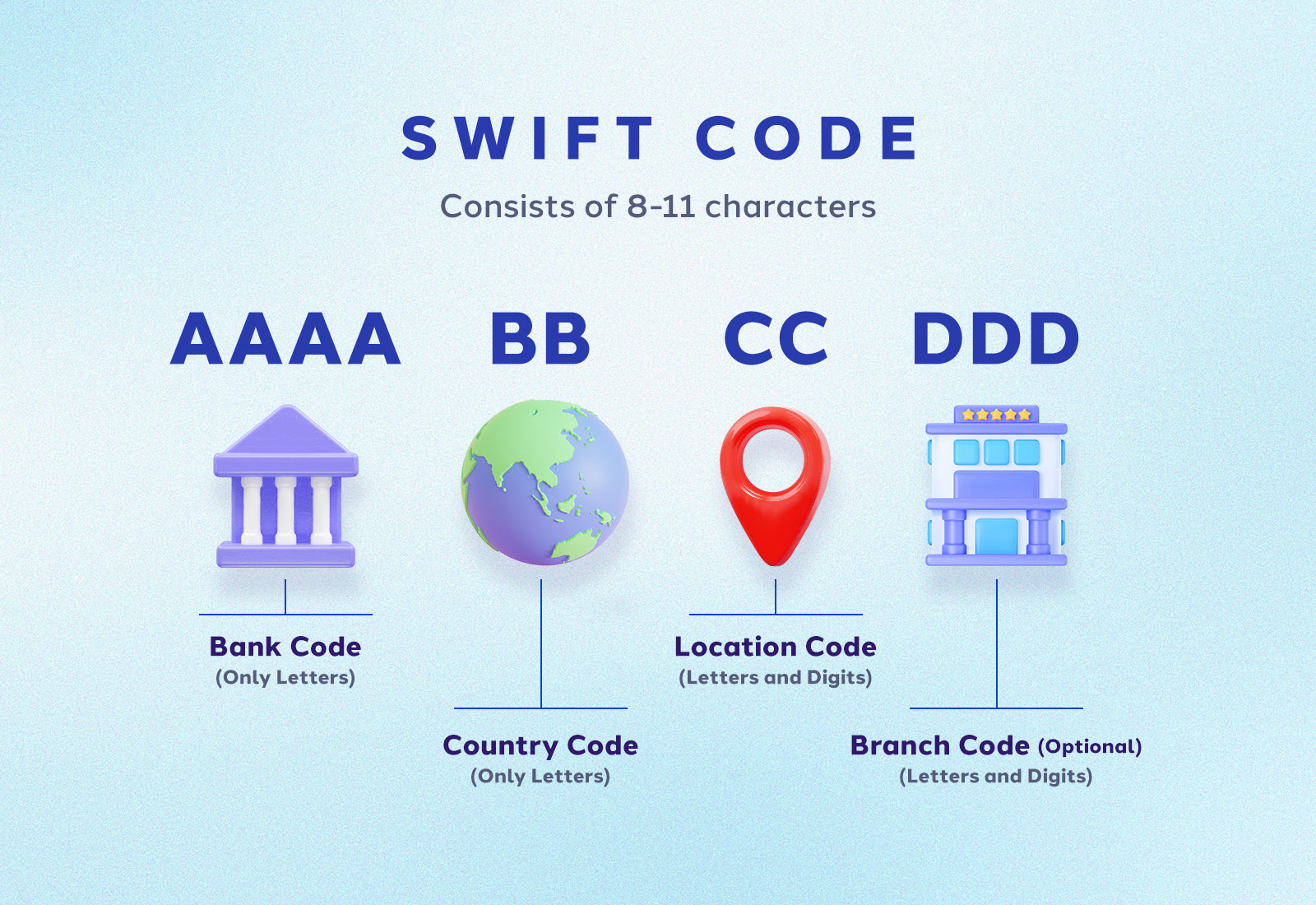

A SWIFT code, also known as BIC (Bank Identifier Code) is an 8 to 11 character code used for routing international payments to the correct bank. It acts like an international postal address for banks. Just as your home address ensures your mail reaches your home, SWIFT code ensures your money reaches the correct bank.

Here’s what the 8 to 11 character code represent:

- First four characters represent the bank code.

- Fifth and sixth characters represent the country code.

- Seventh and eighth characters represent the location code.

- The last 3 digits represent the branch code and this is optional.

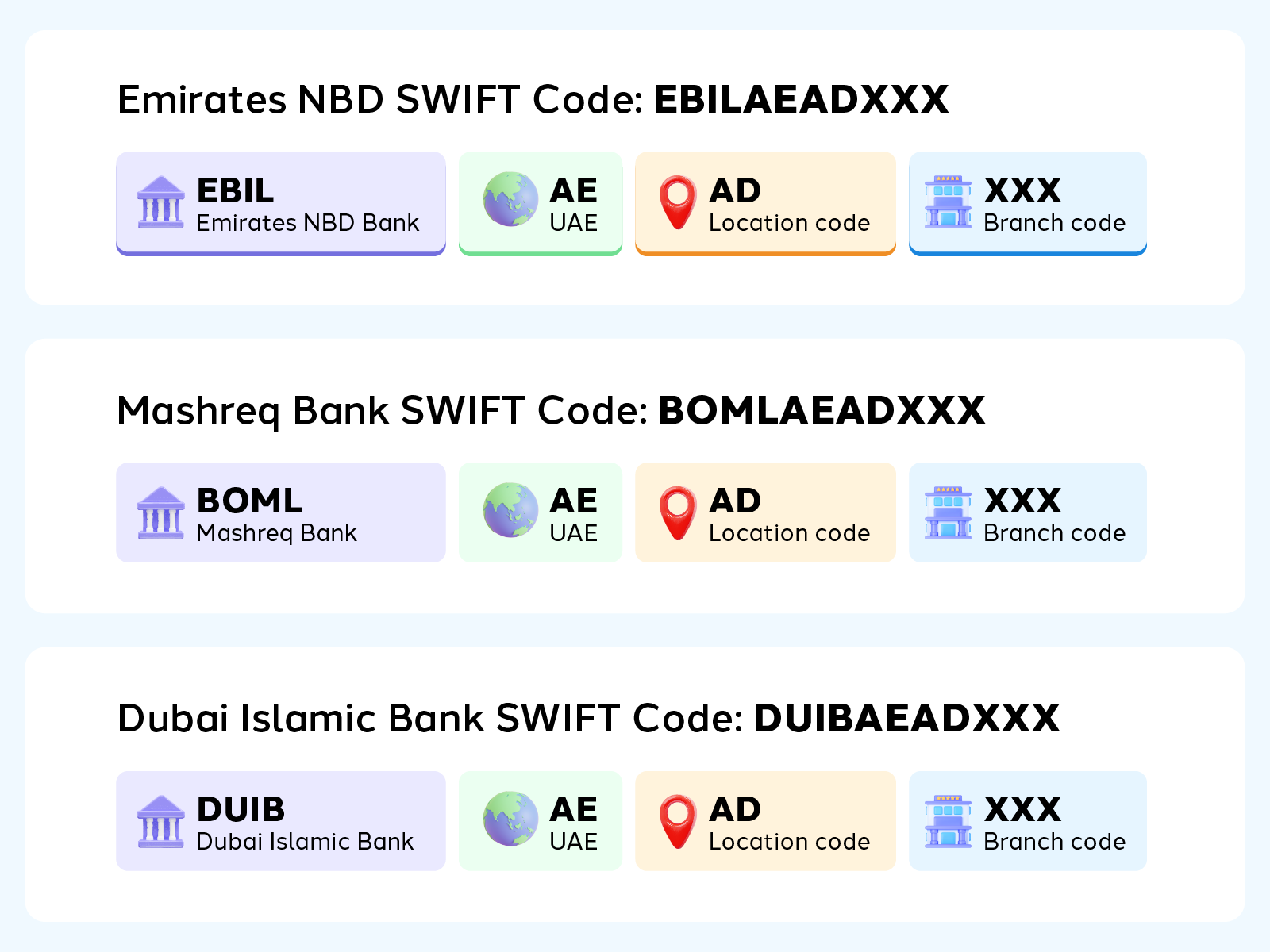

Here’s a simple breakdown of the Emirates NBD SWIFT Code, Mashreq Bank SWIFT Code, and Dubai Islamic Bank SWIFT Code for your reference:

Also Read: A journey through world’s currency symbols!

Why Do You Need a SWIFT Code?

While doing money transfers especially across borders, it is very important to ensure that it doesn’t get lost in the vast international banking network. Here comes the role of SWIFT codes. They act as the GPS coordinates for banks worldwide.

All international money transfers done without SWIFT codes could face delays, rejections, or even bounce back.

So, why is a SWIFT code important? Here are the key reasons:

- Ensure money reaches the correct bank securely without much errors or delays.

- Accepted by banks worldwide and makes global transfers faster and more reliable.

- Provide transparency and tracking for cross-border payments.

If you know the right SWIFT code, make the most of your transfer by checking the live rates now!

What Will Happen if You Enter the Wrong SWIFT Code?

If you enter the wrong SWIFT code, your money transfer may be delayed, rejected, or even returned by the bank. In certain cases, it can take several business days for your money to be transferred back to your account.

If the incorrect SWIFT code that you’ve entered belongs to another legitimate bank, your money might get deposited into the wrong account. Usually, this doesn’t happen because banks reject transfers when account details don’t match.

Additionally, for failed or recalled transactions, banks may charge extra fees. To avoid such situations, always double-check your SWIFT code before hitting “send”.

With the LuLu Money app, you don’t need to re-enter SWIFT codes every time. Just save them once and transfer with ease.

Frequently Asked Questions

How do I find my SWIFT code?

To find your bank’s SWIFT code, you can check the bank’s official website, your bank statement, your online banking account, or contact the branch directly.

Is a SWIFT code the same as an IFSC code?

No. A SWIFT code is used when you do cross-border transactions, while an IFSC code is used for the domestic transfers within India.

Is a SWIFT code mandatory for international transfer?

Yes, it’s using the SWIFT code, banks find out where to route your money. If it is missing or entered incorrectly, your transfer could face delays, rejections, or returns.

Is it safe to share my SWIFT code?

Yes, sharing your SWIFT code is safe and is necessary for international payments. It does not reveal your account number or allow anyone to access your funds.

Do I need both IBAN and SWIFT code for an international transfer?

Yes, you will need it in most cases. The SWIFT code tells you which bank the money is going to, and the IBAN shows the exact account within that bank.