In most countries, money changes its mood overnight.

Exchange rates jump, fall, and force people to rethink plans they made just days ago.

In the UAE, that anxiety is largely absent.

The dirham wakes up looking the same: calm, predictable, almost indifferent to global currency drama. So what keeps the dirham so steady when most currencies move every day?

The answer lies in a deliberate monetary choice known as currency pegging.

Understanding this choice explains why the AED behaves differently from most other currencies.

What is Currency Pegging?

Currency pegging is when a country fixes the exchange rate of its currency to another major currency instead of letting it float freely in forex markets.

Let’s take the case of AED–USD peg:

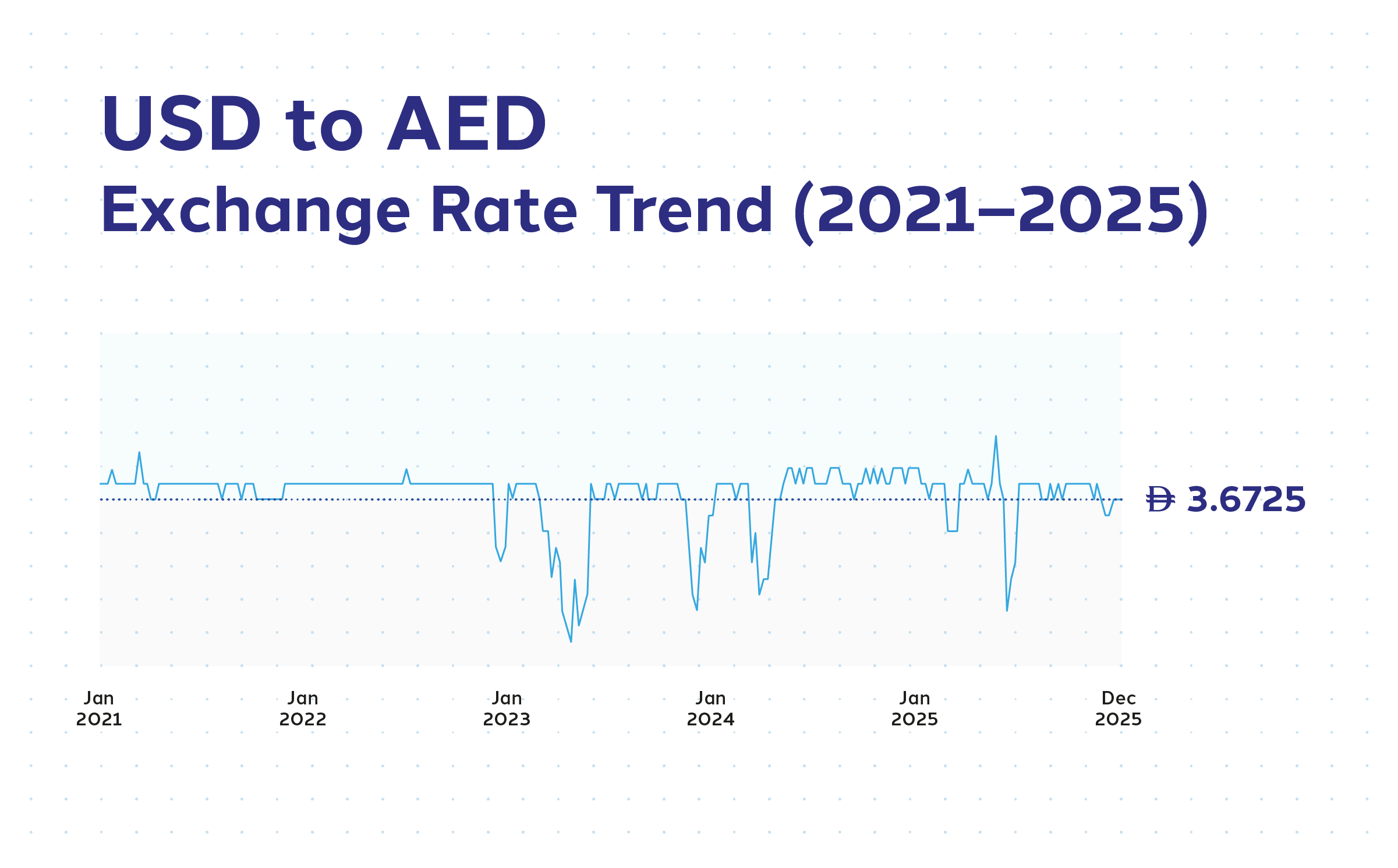

1 US Dollar = 3.6725 UAE Dirhams

This rate has remained unchanged for years, maintained by the Central Bank of the UAE through monetary policy and foreign exchange reserves.

The goal? Stability.

Why the UAE Pegged the AED to the USD

Oil, Trade, and the Dollar Connection

Oil exports, which have been the backbone of the UAE economy, are traded globally in US dollars.

Pegging the dirham to the USD removes currency risk from oil revenues and simplifies international trade.

Predictability for Businesses and Investors

A stable currency helps forecast costs, assess risk more confidently, and avoid the issues that may arise due to currency fluctuations.

This predictability played a key role in positioning the UAE as a global hub for trade, finance, and entrepreneurship.

Stability builds trust and trust attracts capital.

Strong Control Over Inflation

This currency pegging helps the UAE manage inflation by anchoring the dirham to one of the world’s most influential and closely monitored currencies.

A stable currency protects purchasing power. That’s good news for residents, businesses, and anyone sending money home.

Financial Stability & Confidence

A fixed exchange rate tells the world that the country has sufficient reserves and economic discipline to defend its currency. This matters for a nation that thrives on global confidence from tourism to finance to remittances.

Here are the strongest currencies in the world!

How the Peg Works Behind the Scenes

A peg doesn’t survive on trust alone.

The Central Bank of the UAE actively manages interest rates and liquidity, often aligning with US Federal Reserve policy to maintain balance. When the dollar strengthens or weakens, the UAE adjusts to preserve the fixed rate.

This alignment ensures that demand for the dirham remains steady and speculative pressure stays low.

Benefits of a USD-Pegged Dirham

The key benefits of a USD-pegged dirham include:

- Minimal exchange rate volatility

- Lower currency risk for trade and remittances

- Investor confidence

- Price stability for consumers

For anyone sending money from the UAE to over 170 countries, this stability translates into clarity, with fewer surprises and better value visibility.

With the LuLu Money App you can track rates in real time and send money to several countries.

Are There Any Downsides?

Yes! No system is perfect.

While the AED–USD peg brings long-term stability, it also comes with a few trade-offs:

Limited Monetary Independence

Because the dirham is pegged to the dollar, the UAE can’t freely adjust interest rates purely based on domestic economic conditions. Monetary decisions in the US often influence borrowing costs and liquidity in the UAE.

Exposure to US Economic Policy

Changes in US monetary policy, such as interest rate hikes or cuts, directly affect the UAE economy. Even when local conditions differ, the UAE must align closely to maintain the peg.

Less Flexibility During Global Shocks

A fixed exchange rate limits how quickly the currency can adjust during major global economic disruptions. While this reduces volatility, it also means fewer short-term adjustment tools.

Dependence on Strong Foreign Exchange Reserves

Maintaining a peg requires significant foreign currency reserves. While the UAE is well-positioned today, defending a fixed rate always demands ongoing fiscal discipline.

Despite these limitations, the UAE has consistently judged that the benefits of stability outweigh the trade-offs. So far, the results support that choice.

Will the Peg Continue in the Future?

All signs point to yes.

The AED-USD peg is deeply embedded in the UAE’s economic framework, trade relationships, and financial infrastructure. With strong foreign exchange reserves and a diversified economy that still values stability, there’s little incentive to change course.

In a world of financial uncertainty, consistency is a competitive advantage.

Find out the best time to send money from the UAE to India!

The Bigger Picture

The AED–USD peg isn’t just about numbers on a screen.

It’s about removing uncertainty from everyday life.

It’s about ensuring that money behaves predictably, even when the world doesn’t.

And it’s about choosing trust over turbulence.

In a global economy addicted to movement, the dirham’s greatest strength is its refusal to move.

Frequently Asked Questions

Why doesn’t the UAE dirham’s value change like other currencies?

Because the UAE has pegged the dirham’s value to the US dollar. This ensures stability and predictability, thus maintaining a constant exchange rate instead of letting market demand decide the daily rates.

Can the UAE ever remove the peg to the US dollar?

Technically, yes, but practically, it’s unlikely in the near future. Since the peg is deeply tied to trade, investor confidence, and financial stability, removing it would introduce uncertainty.

Does the AED–USD peg affect interest rates in the UAE?

Yes. To maintain the peg, UAE interest rates often move in line with US Federal Reserve decisions. This helps keep capital flows balanced and prevents pressure on the dirham.

What does the peg mean for people sending money from the UAE?

It means fewer surprises. A stable dirham reduces exchange rate volatility, thus making it easier for you to understand the value of money being sent and received across borders.

Is a pegged currency stronger than a floating one?

Not stronger, but will be steadier. While floating currencies can gain or lose value quickly, a pegged currency focuses on consistency, which can be more valuable for trade, investment, and everyday financial planning.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025