When it’s salary day, people around the world will be eagerly waiting for that one thing: their money arriving on time without any discrepancies. In the UAE, to give extra assurance that their salaries are paid on time, the Wage Protection System (WPS) was introduced.

So, what is WPS in UAE, why was it introduced, and how does it impact both employers and employees? Let’s take a closer look.

What is WPS in UAE?

Wage Protection System or WPS in UAE is the electronic salary transfer system developed to ensure that the employees receive their salaries on time. The system was introduced in July 2009 by the UAE Central Bank and the Ministry of Human Resources and Emiratisation (MOHRE).

Why was WPS Introduced?

WPS was introduced in response to multiple reports regarding delayed or missing salaries. This was a common concern for expats who send money home. Even a minor delay in wage payments can result in unpaid rent, missed bills, or hardship for families abroad.

So, the UAE government introduced WPS to:

- Ensure timely wage payments.

- Create a traceable record of salary transfers.

- Prevent disputes between employers and employees.

- Enforce accountability on companies.

- Enhance trust in the labour market.

For businesses who seek to simplify payroll and ensure WPS compliance, explore LuLu Exchange’s Wage & Salary Administrator services!

How Does WPS Work?

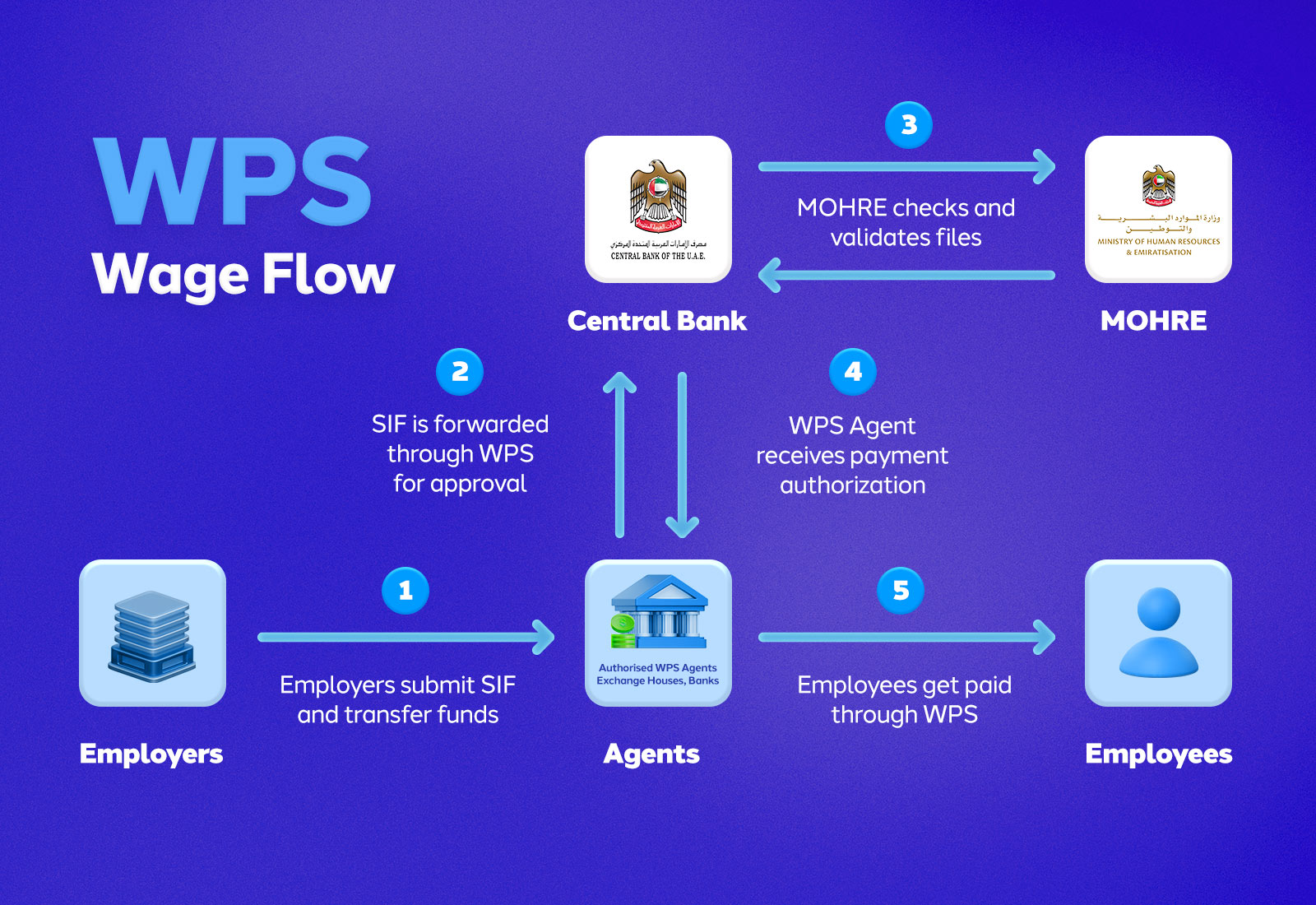

The infographic below shows how wages flow through the WPS system.

Now let’s find out how the Wage Protection System works in the UAE. Here’s a step by step process:

- WPS Registration: Employers must first register with WPS through a UAE bank or with a WPS-approved financial institution.

- Timely Submission of Salary Information: Next, it’s the duty of the employer to submit the Salary Information File (SIF) of the employee through the WPS platform.

- Salary Disbursement: Once the information provided is verified by the Central Bank & MOHRE, the bank issues a payment order through WPS and notifies the employer. Salaries will then be sent to the employee’s bank account via WPS, with email alerts sent if corrections are required.

- Monitoring & Compliance: WPS system ensures that the payment is properly processed and received by the employee. In case of any delays, discrepancies, or payment failures, the employer must resolve the issue and resubmit.

Who Is Included and Who Is Exempt from WPS?

All private sector companies registered with MOHRE are included under WPS.

Those who are exempted from WPS are:

- Employees who have filed a wage-related labour complaint.

- Employees who are officially reported absent as per the ‘work abandonment’ report.

- UAE-national employers who own fishing boats and public taxis.

- Banks and houses of worship.

- New employees in their first 30 days.

- Employees who are on unpaid leave.

If you’ve received your salary on time, you can send money to your loved ones through the LuLu Money App!

How to Register for WPS?

Here’s how you as an employer should register for WPS:

- Register with MOHRE (Ministry of Human Resources and Emiratisation).

- Open a Corporate Bank Account with a bank that supports WPS.

- Select an authorised WPS agent approved by the UAE Central Bank.

- Sign an agreement with the chosen WPS provider.

- Prepare a Salary Information File (SIF) in the required format and upload it through your bank or the WPS system.

- Transfer salaries to employees’ accounts via WPS as per the due dates in their contracts.

- MOHRE and the bank will review the transfers and confirm compliance.

Penalties for Late or Non-Payment of Salaries

Here are the penalties for late or non-payment of salaries:

- On salary due date: All establishments will be monitored electronically for timely payments.

- 3–10 days late: Reminders will be sent to employers.

- 17 days late: Work permit issuance will be suspended for all its establishments; larger companies (50+ employees) may face inspections and get warnings.

- 45 days late (50+ employees): Legal action will be initiated by authorities.

- Repeated violations within 6 months: Fines will be applied and establishments will be reclassified under stricter regulations.

Also Read: How AI Will Impact Money Transfer in the Future

Frequently Asked Questions

Is WPS in UAE only for UAE nationals?

No. WPS in UAE applies to all private-sector employees including the UAE nationals working under the UAE labour law (with certain exemptions).

Which sectors fall under WPS?

The Wage Protection System (WPS) applies to the private-sector companies across all sectors.

Does WPS cover allowances, overtime, deductions?

Yes. The SIF file must include basic wages, allowances, and legally permissible deductions so that net salary is correct.

What should I do if my employer doesn’t use WPS?

If your employer doesn’t use WPS, you can file a complaint with MOHRE/LRA with proper evidence.

Is WPS applicable for part-time employees?

Yes, WPS is applicable for both part-time and full-time employees.

Are there any penalties for late or non-payment of salaries?

Yes. Penalties will depend on how late the payment is and may include fines, suspension of services, or legal action against the employer.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025