Just think back 5 or 10 years. Sending money across borders often meant waiting days or even weeks for it to reach your loved ones. Today, those same transfers reach them in seconds.

Whether it’s a father supporting his family, a student paying tuition abroad, or a business settling accounts overseas, remittances have become faster and more reliable than ever.

Artificial Intelligence (AI) is now rewriting the next chapter. Just as smartphones transformed the way we communicate, AI is transforming the way money moves across borders, making transfers faster, safer, and more human.

If you are staying abroad and need to check the live exchange rates, check them now before we get into the details.

Now, let’s explore how AI will shape the future of payments.

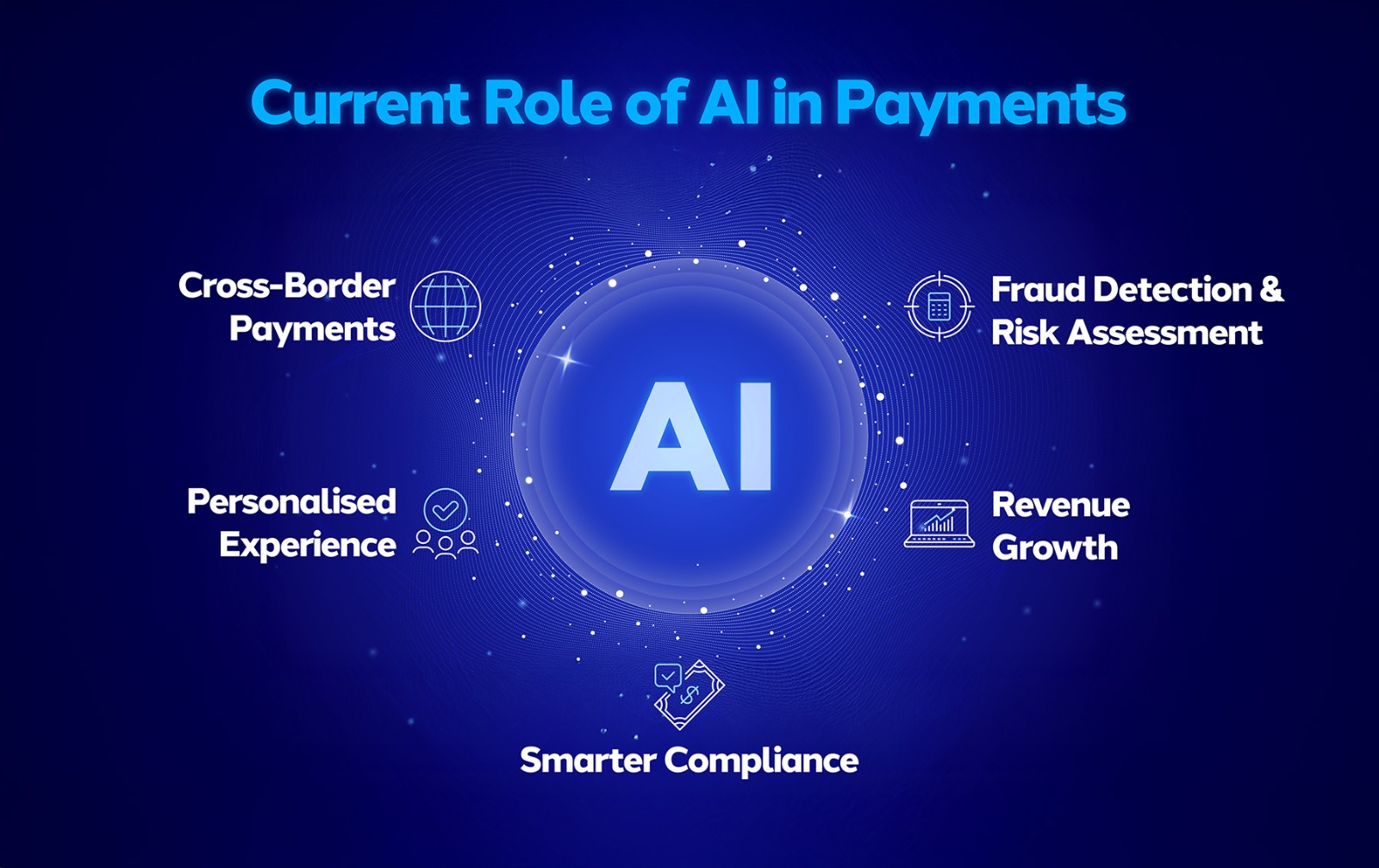

The Current Role of AI in Payments

Before finding out the future impact of AI in payments, let’s first look at how it’s already transforming the payment industry today:

- Fraud detection & risk assessment: AI tracks transaction velocity, device fingerprints, unusual location/IP jumps to detect suspicious activity.

- Revenue growth: The finance/payment industry multiplied their total revenue by leveraging AI-powered insights and efficiencies.

- Smarter compliance: AI streamlines KYC and AML checks by automating tasks like document scanning with OCR, identity verification, and cross-checking against sanction lists.

- Personalised experience: AI makes customer experience more personalised by making use of chatbots, payment suggestions, smoother UIs, voice-enabled interfaces.

- Optimised cross-border payments: AI helps to reduce costs, improve exchange rates, speed-up transfers, and choose optimal routing.

Find out the significance of SWIFT code in cross-border payments!

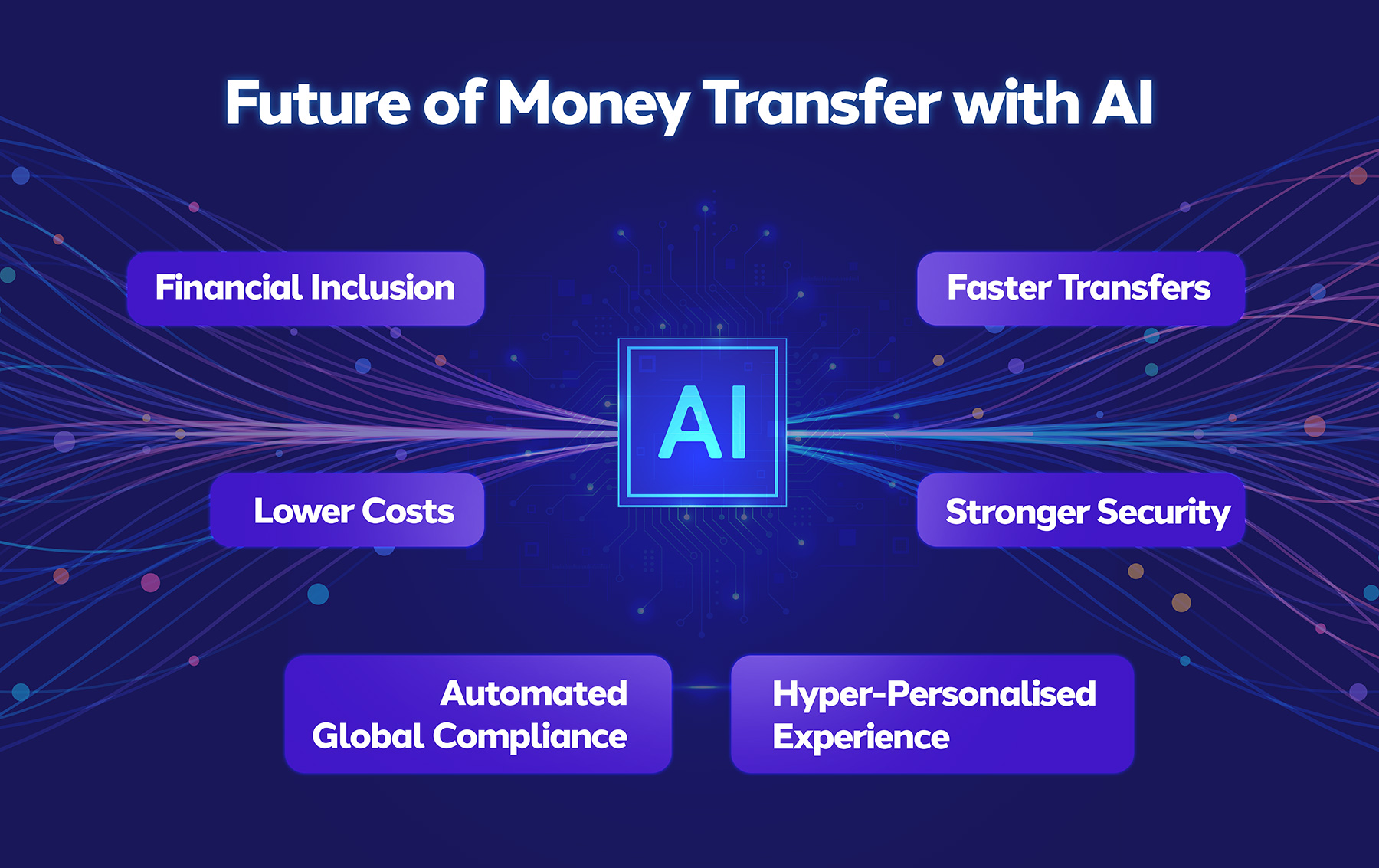

How Will AI Shape the Future of Money Transfer?

From what we see today, AI’s huge potential to redefine the money transfers is evident. Here’s how AI is likely to impact payments in the coming years:

Faster Transfers

Traditional transfers which involved multiple steps and waiting times are now much faster with AI. With instant data analysis and intelligent routing systems, your money reaches loved ones much faster, with speeds set to improve further.

Hyper-Personalised Experience

AI will act as a financial assistant in your pocket by suggesting the best transfer times, predicting your needs, and simplifying every transaction. In this way, it will make every transaction more personal, convenient, and stress-free.

Stronger Security

AI has the ability to detect unusual/fraudulent behaviors in real time whether it’s a login attempt from an unknown device or an unusually high transfer amount.

Risk models are evolving to become even more sophisticated, while counter-AI systems are emerging to deal with fraudsters using AI themselves. As a result, users will be more confidence about the safety of their money.

Automated Global Compliance

AI will evolve to manage compliance seamlessly across borders. It will handle complex regulations, monitor transactions in real time, and predict risks before they occur. In this way, there will be less delays and smoother, more secure international transfers.

Lower Costs

AI doesn’t just make things faster; it makes them cheaper. By automating manual processes and reducing human error, AI helps financial providers cut operational costs, thus letting users pay lower fees, making remittances more affordable for millions.

Customers will see even more transparent, possibly lower, fees in the future.

Send money home using LuLu Money App. Let your love reach home instantly!

Financial Inclusion

Perhaps the most exciting impact of AI is its ability to bring more people into the financial system. By analysing alternative data (like mobile usage or payment history), AI will help assess creditworthiness for people without a traditional banking footprint.

Thus AI will offer safe and affordable transfer services to more migrants, workers, and families, without giving anyone a feeling of being left out of the system.

In short, AI will handle the complexities, so people can focus on what matters most: supporting dreams, staying connected, and building better futures.

What Are the Challenges and Risks of Using AI in the Payment Industry?

Let’s examine the day-to-day challenges and macro-level risks.

Day-to-Day Challenges:

- Different rules in each country make automation tricky.

- Risk of wrongly flagging genuine transfers as fraud.

- Challenge to strictly follow strong data protection and privacy rules.

- Absence of proper infrastructure in certain recipient countries to support AI.

- High integration costs and need for skilled people to maintain AI systems.

Macro Level Risks:

- Potential risks of faster spread of financial shocks (IMF) if many financial organisations use similar AI models.

- Regulators are closely watching how AI is used in fraud checks, money laundering, and cross-border transfers.

- Global payment systems may face new pressures during crises; AI can help predict risks but may also create new weak points.

Have a look at the currency symbols in the world!

Preparing for the Future of Cross-Border Payments

AI is already here. Those who prepare early will win trust and be competitive. Here’s how:

- Start small: Use AI for fraud checks, KYC, or exchange rates in low-risk corridors before scaling.

- Use better data: A model is only as good as the data it learns from. So, use clean, diverse data and respect privacy.

- Focus on user transparency: When the system makes a decision such as delaying or flagging a transaction, or adjusting costs, users should know why. This builds trust.

- Think inclusion: Build AI that works even for people with weak internet, basic phones, or limited documents.

- Work with regulators: Stay ahead of evolving rules on AI, data privacy, and cross-border compliance to ensure long-term stability.

- Maintain human oversight: Even with advanced algorithms, human review of edge cases and escalations is important.

Also Read: What is WPS in UAE?

A Future Scenario

Picture this: You are in Dubai, sending money every month to your elderly parents in the Philippines. If we assume the future scenario, AI could make it look like this:

You open your app, and AI suggests the best time of that day to send money at the lowest fee and best exchange rate.

You scan your ID via the app; AI verifies identity within minutes with OCR + biometric checks.

Your money goes via the optimal routing path, passing through fewer intermediaries, at lower cost.

If delays are expected, you’re alerted and given a choice to proceed or wait.

If there are no delays, your money gets delivered instantly to your parents.

Small, but powerful improvements like these multiply across thousands of users to make the system smoother, cheaper, and more human.

Conclusion

AI has already taken its place in the payment industry becoming the backbone of safer, faster, cheaper, and more inclusive remittances. While technology alone won’t solve every problem, the opportunities are huge.

For providers who embrace AI thoughtfully will build greater trust and loyalty. For users, it means transfers won’t just move money, but will also carry care and connection with far less friction.

Frequently Asked Questions

How will AI change the future of banking?

AI will make banking faster, safer, and more personalised with instant KYC, fraud alerts, and tailored financial advice.

How will AI impact remittances?

It will simplify sending money across borders with instant ID checks, better exchange rates, and fewer delays for families worldwide.

Is AI a threat to banking?

If managed properly, AI won’t be a threat to banking. The real threat comes from poor oversight, biased models, or weak data governance.

Will AI replace humans in the banking sector?

No. AI will handle routine checks and speed up processes, but human oversight will still be key for trust, fairness, and complex cases.

Popular BLOG

January 8, 2026

How UAE Residents Can Save on Remittance Fees During Festive Season

December 23, 2025

Recognising Scams Around You is the First Step to Protecting What You Earn

December 29, 2025

Why AED Is Pegged to USD and Why It Matters to You

November 12, 2025

Why Does the US Dollar Hold the Key to Global Exchange Rates?

October 31, 2025

Best Time to Send Money From UAE to India

October 10, 2025

How to Identify Fake Money Transfer Scams

September 25, 2025

The Ripple Effect: When Everyday Choices Echo Far & Wide

October 6, 2025

WPS in UAE: Everything Employers and Employees Should Know

September 19, 2025

How AI Will Impact Money Transfer in the Future

September 10, 2025