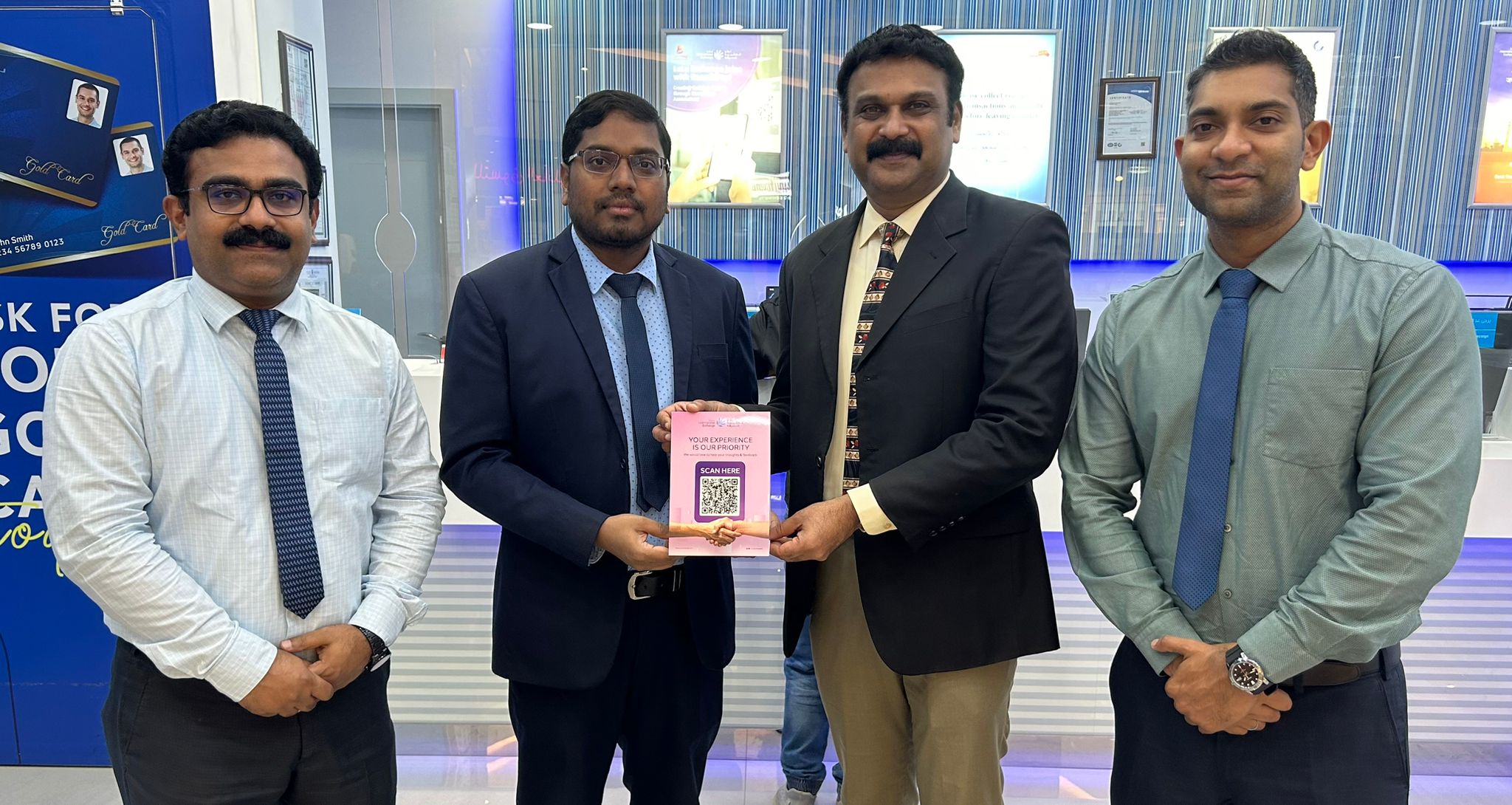

LuLu Exchange opened its 16th branch in Bahrain. The Salmabad branch was inaugurated yesterday by Shaikh Ahmad bin Khalifa bin Salman Al Khalifa, Chairman, LuLu International Exchange BSC in the presence of Adeeb Ahamed, MD, LuLu Financial Group and senior management officials of the company.

The opening strengthens LuLu Exchange’s strong network of branches across the country, and also marks the 246th global branch of LuLu Financial Group.

Shaikh Ahmad congratulated his team on the opening and said the company’s focus on building a network of engagement centres, is aligned with Bahrain’s vision of becoming a payments hub.

Adeeb Ahamed told the media that the Kingdom’s continued recovery and emergence as a regional hub of financial services, positions it strongly for new investments. “The opening of our new branch in the industrial region of Salmabad signals our intent to contribute to this growth story.

The last two years have brought to the fore, the importance of cross-border payments in connecting people. “Through our additional investment into digital technologies, we hope to complement our growing physical network to bring convenience to the payment needs of a cross-section of society.”

Separately speaking to The Daily Tribune, Adeeb Ahamed said digitalization will be one of the top priorities for the company. “It’s a wonderful feeling to open our 16th branch here as we are gradually coming out of the pandemic season. The Kingdom’s great leadership has taken a great decision to thwart the threats caused by Covid-19 virus and the success on the vaccination front offers a testimony in this regard.

“The financial sector is back on the growth track and we are accelerating our digitization efforts to seize the moment. The LuLu Money platform is a pure fintech digitalization aspect of our organization. It was implemented in 2018 and in the last two years we have seen traction in this specific area. Our customers, mainly young customers, have been successfully embracing this platform, who prefer going digital rather than coming to our branches.

“We are envisaging a hybrid model in the coming years where our customers can either visit our branches to receive services or use LuLu Money platform to carry out remittances. So, our focus will be on opening more branches while the core objective will be to boost our functions in the digital space.”

Popular NEWS

May 8, 2025

LuLu Exchange Bahrain awarded 2nd place at Jadara Award, by Chamber of Commerce.

October 14, 2024

LuLu Exchange Partners with Sri Soukya Ayurvedic Centre to Offer Exclusive Discounts on Wellness

October 7, 2024

LuLu Exchange Bahrain Celebrates 11th Anniversary Pioneering Innovation and Digital Transformation

September 13, 2024

LuLu Exchange Bahrain Celebrates ‘September for Customers’ Initiative

September 13, 2024

LuLu Exchange Bahrain Launches Customer Care Initiative to Enhance Customer Experience

September 13, 2024

LuLu Exchange Bahrain Partners with the Embassy of the Republic of the Philippines to Raise Awareness about Online Fraud

July 23, 2024

LuLu Exchange Bahrain Launches eKYC on LuLu Money App

May 10, 2024

LuLu Exchange and REDTAG Collaborate to Bring Exclusive Benefits to Customers

May 8, 2024

LuLu Exchange Celebrates International Workers Day with Appreciation Initiatives

August 30, 2022

LuLu Financial Holdings opens its milestone 250th branch at Dubai Silicon Oasis